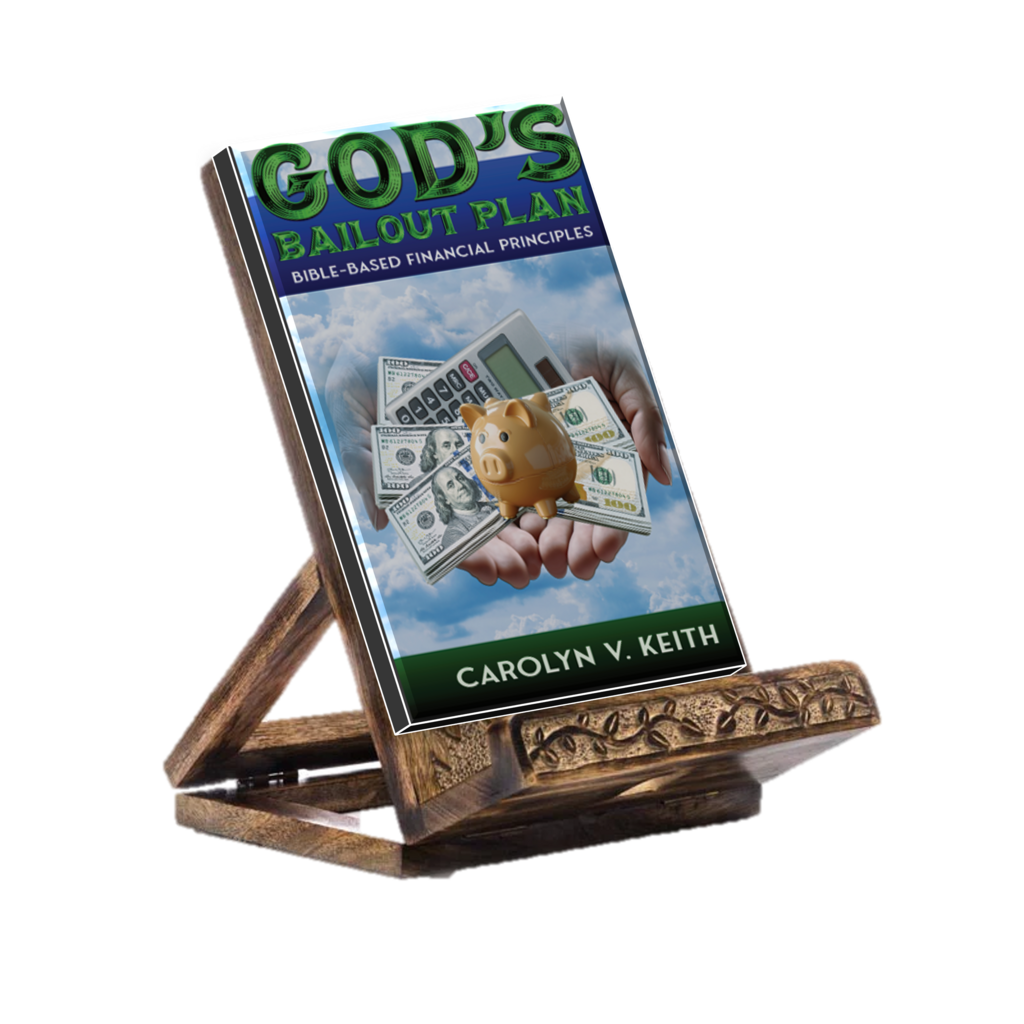

Vineyard Ministry presents:

BIBLE-BASED FINANCIAL PRINCIPALS

Mismanagement of personal finances is one of the most devastating factors that wreaks havoc in the lives of many. The root cause is entering into adulthood without any preparation to handle one’s finances. In general, it is not taught in school or in the home. Most young people embarking on adulthood are left to their own devices. Many soon find themselves buried in debt. Where then can you turn for perfect financial advice? THE BIBLE. Believe it or not, the BIBLE discusses every aspect of personal finances. God’s Bailout Plan takes bible based financial principles and uses practical applications that support HIS principles to get your finances on tract. This book is of benefit to

1) Those in financial turmoil;

2) Those who are seeking to improve in a couple of areas or

3) Those who are curious as to what scripture says about finances.

The book also contains a self- assessment tool that allows you to gauge where you are on the financial spectrum. Advice is also provided to address identified weaknesses. It’s never too late to turn your situation around. Let’s get started!

About the author

Carolyn V Keith

Carolyn Keith is a dedicated Christian, who wears many hats. In addition to being the pastor’s wife, she serves as the church’s financial secretary, the teen Sunday school teacher, and the retreat and summer camp chair. Carolyn is a Certified Public Accountant and holds a Bachelor’s Degree in Accounting and a Master’s Degree in Management, Finance and Marketing. She has over 20 years of experience at the executive level in the finance and accounting fields. The culmination of the two vocations (i.e. Christian and Certified Public Accountant) led to God’s Bailout Plan. She lives with her husband, Lloyd, in Northwest Indiana. They have four children (three of whom are married) and six grandchildren.

What's inside

The descriptions below provide summary chapter previews of God’s Bailout Plan.

WORKSHOPS

ADULTS (Ages 18 - up)

Vineyard Ministry offers workshops designed to assist individuals in managing personal finances. These workshops have been developed for adults and youth. We also offer a workshop on planning conferences, retreats, Vacation Bible School, or Bible Study. These workshops can be administered on-site or via Zoom. Please get in touch with us via email or phone to book your workshop today.